What are Options?

Table of Contents

Options are a very complex topic but nevertheless this article tries to give you a simple and illustrated introduction.

Introduction

An option is a standardized contract between two parties. The two parties are called the seller and the buyer of the option. The contractual object is the so called underlying which can be a stock, a future contract or a stock index. Stock options are the most popular type of options which is why we focus on them in this article.

Since a contract becomes effective once two parties agree to it an option is "created" whenever a seller offers an option in the market and a buyer agrees to buy it for a given price (the so called premium).

In a simplified way a typical option trade looks like this:

Calls and Puts

There are two types of options. Call options and put options.

Calls

A call option gives the buyer the right (but not the obligation) to buy 100 shares of the underlying stock from the seller for the strike price as long as the option has not expired no matter what the real price of the stock is in the market. The strike price is a fixed price that is part of the option contract from the moment it is created until the moment it expires.

Let's say the stock of Microsoft is at $290 and our option buyer thinks that it will rise. He buys a call option on Microsoft with a strike price of $300 and he has the $30,000 he would need to buy the stock for this price in his account. To buy the option he pays a premium of $350 to the seller of the option. Now the situation is like this:

A short time later the stock rises to $320 and our option buyer exercises the option. That means he pays the seller $30,000 and gets 100 Microsoft stocks that are worth $32,000 at the time:

He can now sell the shares in the market and take a profit of 32,000 - $30,000 - $350 = $1,650. But the great thing with call options is that he doesn't need to buy and sell the shares in the stock market.

He can just sell the option in the option market without exercising it and take the same profit because the price of the option has risen accordingly. That means he doesn't need the $30,000. He only needs the $350 to buy the call option.

Of course the picture is different if the stock decreases in value until the option expires. In this case the option becomes worhtless and the $350 are lost.

If the option buyer had bought 100 stocks instead of the call option he would have needed to use $29,000 and if the stock goes down he might easily lose more than $350.

This example teaches us that call options can be used to speculate on an increase in the price of a stock while using only a fraction of the capital you would need to buy the actual shares (in this case $350 vs $29,000).

Puts

A put option on the other hand is the opposite of a call option. It gives the buyer the right (but not the obligation) to sell 100 shares of the underlying stock to the seller of the option for the strike price.

Let's say our option buyer owns 100 Apple stocks which are worth $160 at the time. There is some turmoil in the market and he is afraid that his stocks might tank. Therefore he buys a put option with a strike price of $150 for a premium of $100.

The put option gives him the right (but not the obligation) to sell his 100 Apple stocks to the seller of the option for $150 per share as long as the option has not expired. Of course this makes only sense when the price of Apple falls below $150. Let's say this happens and Apple goes down to $140:

Our option buyer can now exercise his put option and sell his 100 Apple stocks for $15,000 to the seller of the option although he would only get $14,000 if he sold them in the stock market.

In this example the buyer of the put option used it to insure his stocks against a sudden drop in price. The seller on the other hand sold him insurance. He did this to earn the premium and he probably thought that buying Apple for $150 per share would be good idea.

As in our previous example the buyer of the option doesn't need to sell his shares. He could instead just sell the option in the option market. That would give him a cash profit of $15,000 - $14,000 - $100 = $900. He would still have his stocks and be compensated for the drop in price. Of course this would not save him if the stock keeps falling.

But put options can't only be used for insuring stocks you own. They can also be used to speculate on a price drop in a stock you don't own. That means buying a put option on a stock is like selling it short. The advantage over a real short position is that in case you are wrong and the stock goes up you can only lose the premium you payed for the put option. Compare this to the unlimited risk you have when actually selling a stock short.

Expiration

Every option expires at a pre-defined date. The expiration date is a part of the option contract. It can be days, weeks, months or even a few years into the future.

On the expiration date (usually at the end of day after trading hours) the option ceases to exist. This means the buyer of the option loses the right to buy or sell the stock from or to the seller and the seller of the option loses the obligation to buy or sell the stock. The option disappears from the brokerage accounts of both parties.

There is a regular expiration day every month which is always on the third Friday of the month. Options are traded not on all but only on the most popular of stocks. For all of those optionable stocks options are traded that expire on the regular expiration day. Many of the super-popular stocks (e.g. AAPL, MSFT, JNJ) also have so called weekly expiration dates which cover every other Friday of the month. That means that you can chose every Friday of the year as the expiration date of the options you want to buy or sell.

If the exchange is closed on a Friday because of a holiday options might already expire on Thursday, instead.

A list of typical weekly and regular expiration dates could look as folows:

| Friday, Mar 4, 2022 |

| Friday, Mar 11, 2022 |

| Friday, Mar 18, 2022 (Regular) |

| Friday, Mar 25, 2022 |

| Friday, Apr 1, 2022 |

| Friday, Apr 8, 2022 |

| Friday, Apr 14, 2022 (Regular) |

| Friday, Apr 22, 2022 |

Parameters of an Option Contract

Since a stock option is a standardized contract all you need to define such a contract are four parameters:

| Description | Example | |

|---|---|---|

| Option Type | Call or Put | - |

| Underlying Stock | The stock which is subject to the option contract. | Apple (AAPL), Microsoft (MSFT), Johnson & Johnson (JNJ)... |

| Strike Price | The price that has to be payed for the stock if the option gets exercised | $150 |

| Expiration Date | The date when the option becomes worthless and ceases to exist. The buyer loses his rights granted by the contract and the seller is freed of his obligations. | March 18, 2022 |

With so few parameters being sufficient for defining an option contract it comes with little surprise that people have invented a compact notation for naming option contracts.

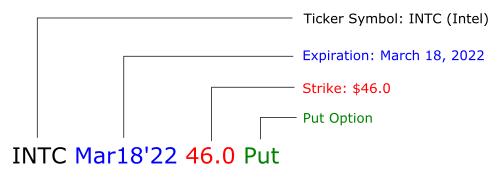

In this notation you could write a put contract on Intel stock with an expiration date of March 18, 2022 and a strike price of $46 like this:

It looks a little bit cryptic if you aren't used to this notation but with time it becomes second nature.

So let's dissect this:

Obligations, Benefits, and Risks

There are good reasons to buy options and there are good reasons to sell options. Both courses of action come with different obligations, benefits, and risks.

It is important to understand them before trading with options. Therefore we have summarized them in the following tables.

Option Buyers

| Buyer Obligations | Buyer Benefits | Buyer Risks | |

|---|---|---|---|

| Call | Has to pay the premium |

|

If the option expires worthless the premium he payed for the option is lost |

| Put | Has to pay the premium |

|

If the option expires worthless the premium he payed for the option is lost |

Option Sellers

| Seller Obligations | Seller Benefits | Seller Risks | |

|---|---|---|---|

| Call | Has to sell 100 shares per call option for the strike price if exercised | He takes the premium and if the option expires worthless he has no further obligations |

|

| Put | Has to buy 100 shares per put option for the strike price if exercised | He takes the premium and if the option expires worthless he has no further obligations |

|

Option Chains

An option chain is a price table which shows you what option contracts are available on a given stock with a given expiration date and how much buyers are bidding to buy them and how much sellers are asking to sell them.

Call Option Chain

So let's say you wanted to buy a call option on Intel stock which expired on March 18, 2022. If you had looked up the call option chain for Intel on March 7, 2022 you might have gotten something like this:

| Last | Change | Bid | Ask | Strike |

|---|---|---|---|---|

| 2.11 | -0.21 | 1.99 | 2.06 | 46.50 |

| 1.77 | -0.21 | 1.66 | 1.74 | 47.00 |

| 1.41 | -0.25 | 1.37 | 1.44 | 47.50 |

| Current Stock Price 47.68 | ||||

| 1.18 | -0.16 | 1.07 | 1.16 | 48.00 |

| 1.05 | -0.06 | 0.87 | 0.92 | 48.50 |

| 0.74 | -0.14 | 0.66 | 0.74 | 49.00 |

Since we have already chosen a stock and an expiration date and use an option chain that only shows us the call contracts all we have to look for is the stirke price to pick one specific option contract.

But first the columns of this table deserve some explanation:

Last: The last price for which an option of this type was actually sold.

Change: The change in the price of the option since the last quotation (this usually updates every few minutes). It gives you a rough estimate in which direction the option price is going.

Bid: The highest price a buyer is willing to pay for this kind of option.

Ask: The lowest price for which a seller is willing to sell this kind of option.

Strike: The strike price of this option. Since you have already chosen a stock and an expiration date the strike ultimately defines the type of option.

Note on Option Prices:

The prices for options are usually shown as the "option price per stock". Since an option is a contract about 100 stocks that means that you have to multiply the price shown in the option chain by 100 to get the real price the option trades for. So if you see a price of $0.87 that means the actual price of one option contract is $87.

So how do you use such a table?

Let's say you want to buy a 48.50 call. From the option chain you can see that the cheapest seller asks a price of $0.92. If you are fine with that price you could place a market order and with some luck your order might get filled for that price within seconds. In that case you would get one option of type INTC Mar18'22 48.5 Call and pay $92 plus the transaction fee of your broker.

But using a market order to buy or sell options is a bad idea since the option market is a lot less liquid than the stock market. And even in the stock market market orders aren't that great of an idea.

So you should always use a limit order when trading options. If you offer a price that is close to the ask price and your market data is in real time your order should be filled immediatelly. If you want to get a better price you can chose a limit price that is between the bid and the ask like 0.89. With some luck your order might still be filled in a short amount of time. You can also chose a price that is below the bid price and hope that the market moves in your direction (the asking price goes down). This will take longer and the farther you get away from the ask price the bigger the risk that your order will never be filled.

Put Option Chain

A put option chain looks basically the same as a call option chain but with different prices. This put option chain shows the put prices for Intel option contracts at the same time as the call chain:

| Last | Change | Bid | Ask | Strike |

|---|---|---|---|---|

| 0.85 | 0.03 | 0.83 | 0.91 | 46.50 |

| 1.00 | 0.09 | 1.00 | 1.05 | 47.00 |

| 1.17 | 0.09 | 1.20 | 1.27 | 47.50 |

| Current Stock Price 47.68 | ||||

| 1.48 | 0.20 | 1.43 | 1.49 | 48.00 |

| 1.67 | -0.04 | 1.69 | 1.76 | 48.50 |

| 1.86 | -0.02 | 1.98 | 2.06 | 49.00 |

Of course the last prices, the changes and the bid and ask prices are different because different trades are made in puts than in calls.

But if you compare the two tables you might notice that the puts get cheaper the more the strike is below the current stock price and more expensive the more the strike prices is above the current stock price. For calls it is vice versa.

The reason for this is the intrinsic value of the options at different strike prices and we will talk about that in the following chapter.

Combined Option Chain

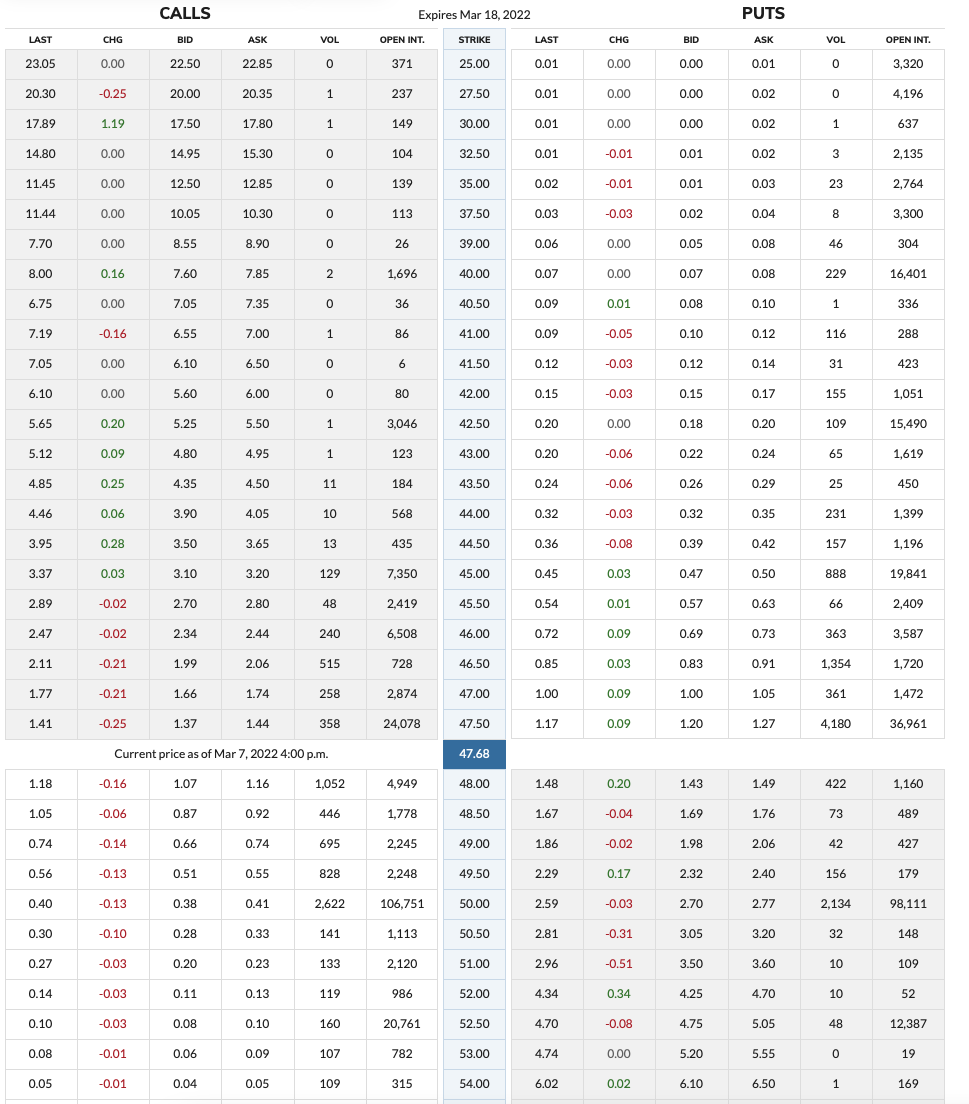

The option chains we have seen so far were a bit simplified. When you lookup an option chain in a trading program or on a website like marketwatch.com you will see more info and often you will also see combined option chains where the calls as well as the puts or combined into a single table:

This looks a little overwheling at first but once you get used to it shows its advantages.

Having the full option chain with calls and puts on display at once gives you a broader view of the market and it also prevents you from making mistakes. When you work with a trading program and you configure it to display only calls or puts and you switch between them as needed it is easy to forget to switch and think you work with the other option type. When this happens you will work with the wrong prices and you might even buy or sell a call instead of a put or vice versa.

Therefore it is a good idea to get used to the full option chain view.

Note on the extra Columns:

Vol: The number of contracts traded in a given time frame.

Open Int.: The number of open contracts between two parties that haven't been settled, yet.

Option Value

Intrinsic Value

Let's say you have a call option on Microsoft with a strike price of $280 and the stock price is at $281.

If you exercise the option right now you pay $280 per share. If you sell the stocks immediately you make a profit of $1 per share. Since one option allows you to buy 100 shares you can make a total profit of $100.

This possible profit is called the intrinsic value of the option. It changes whenever the stock price changes. But for the moment the intrinsic value of your Microsoft call option is $281. It becomes 100 * $5 = 500$ if the stock goes up to $285 and it becomes 0 if the stock goes down to 280. It also stays at 0 if the stock goes below $280.

Of course you could exercise the option when the stock price is at $275. That would mean you buy 100 shares from the option seller for $280 and sell them for $275. That way you take a loss of $500. That makes no sense and no one in his right mind would do this so therefore the intrinsic value of a call option is considered to be 0 as long as the stock price is at or below the strike price.

Moneyness:

Moneyness is the idea of describing the situation of the intrinsic value of an option with a few simple words. An option can be:

In the Money: The option has an intrinsic value.

At the Money: The stock price is at or very close at the strike price and the intrinsic value of the option is basically 0.

Out of the Money: The intrinsic value of the option is 0 and the stock price is not at the strike.

With put options things are the other way around. If you have a put option on Microsoft with a strike of $280 and the stock price is $275 you can buy 100 shares for $275 each and sell them for $280 each to the seller of the option. This would leave you with a profit of $500. Therefore the intrinsic value of the option at that point in time is $500.

Time Value

If an option is out of the money its intrinsic value is 0. But does that mean that it is worthless? Of course not. As long as an option is not expired the market can still turn and the option can get in the money (no matter how unlikely it may be). The more days, weeks, or months are left until expiration the higher the chance that the option might not expire worthless. This chance is worth something and it reflects in the time value of the option that is payed by the market.

Let's revisit our call option chain from before and calculate the intrinsic value of each option to get an idea what difference time value makes like in practice (the options have 11 days till expiration):

| Last | Change | Bid | Ask | Int. Value | Time Value | Strike |

|---|---|---|---|---|---|---|

| 2.11 | -0.21 | 1.99 | 2.06 | 1.18 | 0.845 | 46.50 |

| 1.77 | -0.21 | 1.66 | 1.74 | 0.68 | 1.02 | 47.00 |

| 1.41 | -0.25 | 1.37 | 1.44 | 0.18 | 1.225 | 47.50 |

| Current Stock Price 47.68 | ||||||

| 1.18 | -0.16 | 1.07 | 1.16 | 0.00 | 1.115 | 48.00 |

| 1.05 | -0.06 | 0.87 | 0.92 | 0.00 | 0.895 | 48.50 |

| 0.74 | -0.14 | 0.66 | 0.74 | 0.00 | 0.70 | 49.00 |

As you can see here the intrinsic value of a call option grows bigger the deeper it is in the money. It becomes zero and stays zero as the option gets out of the money. That means that the value of out of the money options is pure time value.

The time value is calculated by using the average of the bid and the ask as the assumed market price of the option and subtracting the intrinsic value.

Choosing Stocks for Option Trading

Not all optionable stocks are created equal. The best stocks to trade options on have the following qualities:

- Dense Strikes: When we looked at the option chain at the Intel stock we had strikes like 46.50, 47.00, 47.50 and so on. These strikes are only 50 cents apart which is as dense as it gets. With less popular stocks you can find strikes that are much farther apart like e.g. 42.50, 45.00, 47.50, 50.00 and so on. With gaps in the strikes come gaps in price and risk/reward which is tightly coupled to the strike price. Dense strikes give you much more flexibility which is why you should always check the available strikes before trading options on a particular stock

- Weeklies: It is not only good to have a lot of different strikes to chose from but ideally you also have a lot of expiration dates available. This gives you flexibility and makes it easier to get out of the way of earnings and ex-dividend dates which can have an big impact on the movement of the stock price.

- High Liquidity: If a stock has dense strikes and weeklies it quite probably has a high liquidity. If it doesn't check the option trading volume. Nothing is worse than being in a losing position and not being able to get out because the market for your options is dried up.